What is a Cryptocurrency Fork

Cryptocurrency fork are events that have the power to reshape the landscape of blockchain networks and their associated cryptocurrencies.

Cryptocurrency fork are events that have the power to reshape the landscape of blockchain networks and their associated cryptocurrencies. In this comprehensive 2500-word guide, we will explore the intricacies of cryptocurrency forks, demystifying their types, reasons for occurrence, and the significant impact they have on the blockchain ecosystem.

The Genesis of Cryptocurrency Fork

To comprehend cryptocurrency forks, we must first delve into the genesis of blockchain technology and its revolutionary impact on digital currencies:

What Is Blockchain?

Blockchain is a distributed ledger technology that records transactions across a network of computers (nodes) in a secure, transparent, and tamper-resistant manner. Each transaction is grouped into a block, and these blocks are linked together in chronological order, forming a chain. The decentralized nature of blockchain technology eliminates the need for centralized authorities like banks.

Cryptocurrencies and Blockchain

Cryptocurrencies, often referred to as digital or virtual currencies, are built on blockchain technology. They leverage cryptographic techniques to secure transactions, create new units, and validate the transfer of assets. Bitcoin, introduced by the pseudonymous Satoshi Nakamoto in 2009, was the first cryptocurrency and remains the most well-known.

Unpacking Cryptocurrency Forks

Now, let's explore what cryptocurrency forks are and the various types:

What Is a Cryptocurrency Fork?

A cryptocurrency fork is a fundamental change or divergence in the blockchain protocol that results in two separate and distinct chains, each with its version of the blockchain and associated cryptocurrency. These forks can be caused by various factors, including changes in consensus rules or disagreements within the blockchain community.

Types of Cryptocurrency Forks

Cryptocurrency forks can be broadly categorized into two main types:

- Soft Forks: A soft fork is a backward-compatible upgrade to the blockchain protocol. It tightens the rules for consensus, making previously valid blocks or transactions invalid. Older nodes can still participate in the network, but they must adhere to the new rules. Soft forks are typically less contentious.

- Hard Forks: A hard fork is a non-backward-compatible upgrade to the blockchain protocol. It introduces significant changes that render older nodes incompatible with the new chain. Participants must either upgrade their software or choose to follow the new chain. Hard forks are often contentious and can lead to the creation of a new cryptocurrency.

Reasons for Cryptocurrency Fork

Cryptocurrency forks can occur for a variety of reasons, and understanding these motivations is crucial to grasping their impact:

Technical Upgrades

One common reason for cryptocurrency forks is to implement technical upgrades and improvements to the blockchain network. These upgrades can enhance security, scalability, transaction speed, or other aspects of the network's functionality.

Disagreements among Developers

Developers and contributors to blockchain projects may have differing views on the direction and features of a network. These disagreements can lead to forks as different factions within the community advocate for their preferred changes.

Scaling Solutions

Blockchain networks like Bitcoin often face scalability challenges as they grow in popularity. Forks can be used to implement scaling solutions that increase the network's capacity to handle more transactions, such as the contentious Bitcoin Cash fork.

Governance and Consensus Rule Changes

Changes in governance structures or consensus rules can also trigger forks. In some cases, stakeholders may disagree on how decisions are made within the network, leading to a separation of chains.

Ideological Differences

Differences in the philosophical or ideological direction of a blockchain project can result in forks. Participants with contrasting visions may choose to part ways and create separate chains.

Real-World Examples of Cryptocurrency Fork

To better understand the impact of cryptocurrency forks, let's explore some notable real-world examples:

Bitcoin Cash (BCH)

Bitcoin Cash was created in August 2017 as a result of a hard fork from the original Bitcoin (BTC) blockchain. The fork aimed to increase the block size limit to allow for more transactions per block and faster confirmation times. Bitcoin Cash proponents argue that it is a more scalable and efficient digital cash system.

Ethereum (ETH) and Ethereum Classic (ETC)

Ethereum experienced a hard fork in 2016 following the infamous DAO (Decentralized Autonomous Organization) incident. The fork was contentious, with some participants choosing to continue on the original Ethereum chain (Ethereum Classic) while others followed the new chain (Ethereum). The fork was a response to a smart contract vulnerability that resulted in a significant amount of ether (ETH) being stolen.

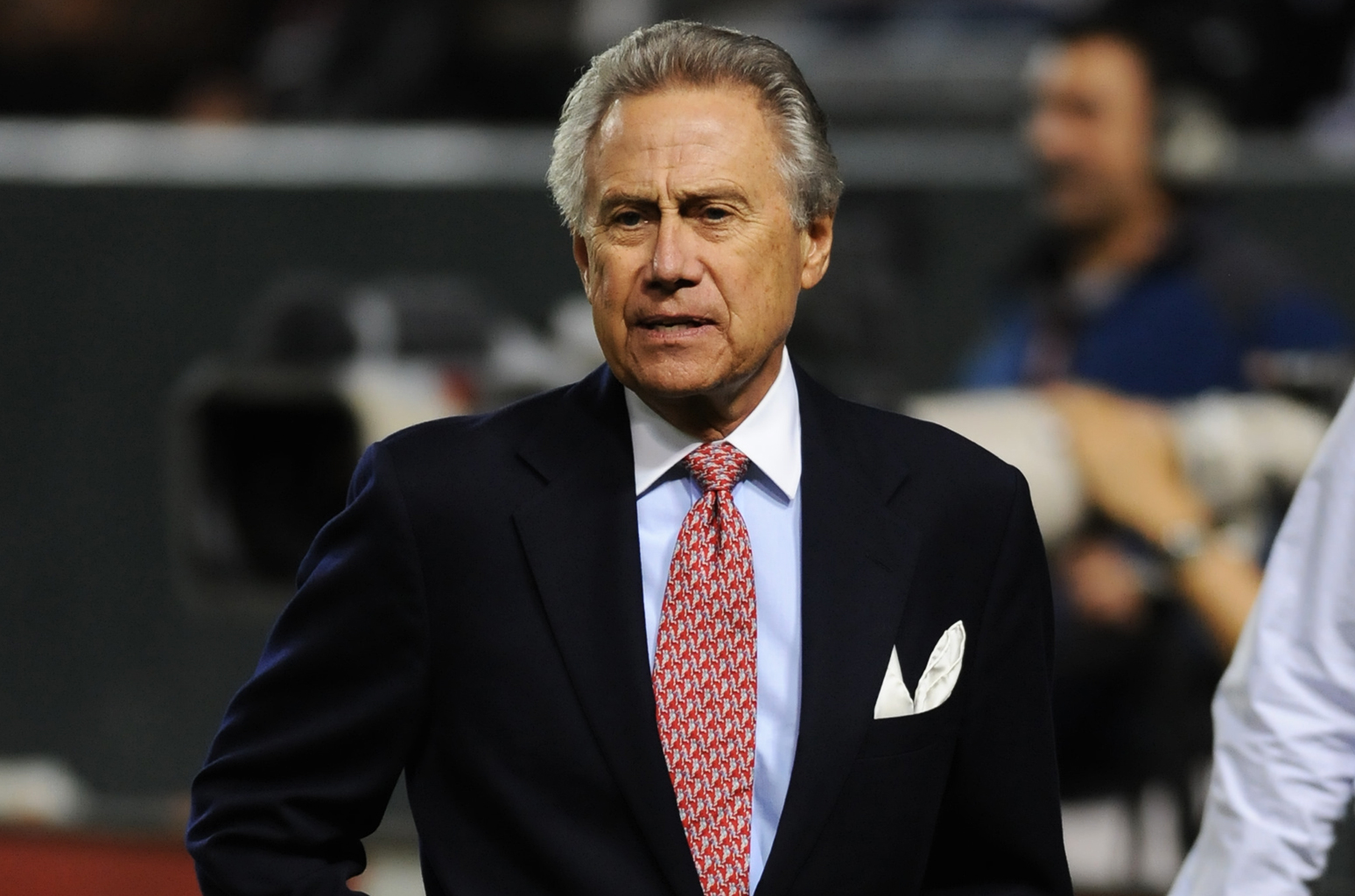

Bitcoin SV (BSV)

Bitcoin SV, short for "Bitcoin Satoshi Vision," emerged from a contentious hard fork of Bitcoin Cash in November 2018. The fork was primarily driven by a dispute between factions over the direction and scalability of the Bitcoin Cash network. Bitcoin SV proponents aimed to restore what they saw as the original vision outlined in Satoshi Nakamoto's whitepaper.

Monero (XMR) and Monero Classic (XMC)

Monero experienced a fork in 2018, leading to the creation of Monero Classic. The fork was primarily driven by ideological differences, with Monero Classic supporters opposing changes that aimed to enhance privacy and security features.

The Impact of Cryptocurrency Fork

Cryptocurrency forks have significant consequences for both the original and new chains, as well as the broader blockchain ecosystem:

Creation of a New Cryptocurrency Fork

Hard forks often result in the creation of a new cryptocurrency that shares a common history with the original chain up to the fork point. Holders of the original cryptocurrency typically receive an equivalent amount of the new cryptocurrency.

Community and Developer Divisions

Forks can create divisions within the cryptocurrency community and among developers. Disagreements and disputes surrounding forks can be divisive and impact the cohesion of a blockchain project.

Market Impact

Forks can have a significant impact on the market value of cryptocurrencies. The creation of a new cryptocurrency can lead to price volatility and uncertainty, as traders and investors assess the implications of the fork.

Network Security

Forks can impact the security of blockchain networks, especially when there is a contentious split. Hashrate may be divided between the original and new chains, potentially making both networks more vulnerable to attacks.The Role of Consensus in Forks

Consensus mechanisms play a vital role in the occurrence and resolution of cryptocurrency forks:

Proof of Work (PoW) vs. Proof of Stake (PoS)

The consensus mechanism employed by a blockchain network can influence the likelihood and impact of forks. PoW networks, like Bitcoin, may experience contentious hard forks when there are disagreements over upgrades. PoS networks, on the other hand, tend to have a more structured governance process that can mitigate conflicts.

Governance Models

Blockchain projects with formalized governance models are better equipped to address disagreements and potential forks. These models may involve voting by token holders to decide on network upgrades and changes.

Forks and Innovation

While cryptocurrency forks are often associated with disputes and divisions, they also serve as catalysts for innovation:

Experimentation

Forks allow blockchain communities to experiment with different features, scalability solutions, and consensus rules. This experimentation can lead to the development of new technologies and improvements.

Competition

Competition between different chains and projects can drive innovation as teams strive to outperform one another in terms of features, speed, security, and user adoption.

Navigating the Forked Path

Participants in the cryptocurrency ecosystem, including users, developers, and investors, must navigate the complexities of forks:

User Responsibility

Users of cryptocurrency wallets and platforms should stay informed about upcoming forks and take necessary precautions to protect their assets. This may include updating software, securing private keys, and understanding the implications of a fork.

Developer Coordination

Developers play a crucial role in proposing and implementing changes to blockchain networks. Coordination and communication among development teams and the community are essential to avoiding contentious forks.

The Future of Cryptocurrency Fork

The future of cryptocurrency forks remains uncertain, but several trends and possibilities are worth considering:

Governance Solutions

Blockchain projects are exploring governance solutions that allow token holders to vote on proposed changes, potentially reducing the likelihood of contentious forks.

Interoperability

Efforts to enhance interoperability between different blockchains may reduce the need for contentious forks by allowing assets to move seamlessly between chains.

Regulatory Considerations

Regulatory authorities are increasingly focusing on cryptocurrency projects. Future forks may need to navigate evolving regulatory frameworks.

Cryptocurrency forks are a natural and, at times, contentious part of the blockchain ecosystem. They reflect the decentralized nature of these networks, where stakeholders can express their preferences through code and consensus.

Understanding the motivations, impact, and potential consequences of forks is essential for participants in the cryptocurrency space.

As blockchain technology continues to evolve, forks will remain a dynamic force, shaping the future of decentralized finance, digital currencies, and the broader blockchain ecosystem.

What's Your Reaction?

.jpg)